Lifetime allowance

It has been frozen at 1073m since the. Web Labour has pledged to reverse plans to abolish the lifetime pensions allowance if it wins power calling it a Tory tax cut for the rich.

What Is The Lifetime Allowance

Web The Money Purchase Annual Allowance will be increased from 4000 to 10000.

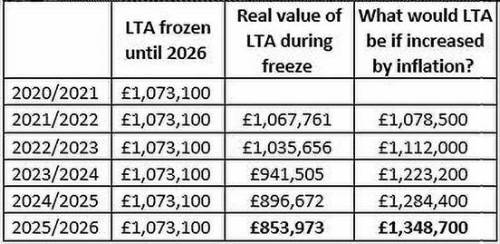

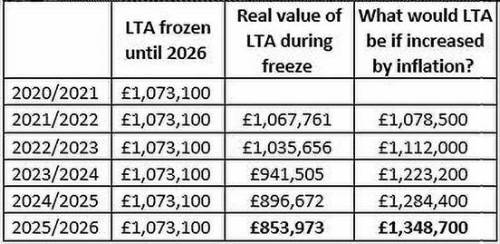

. Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. The party released analysis saying.

Web The lifetime allowance is expected to rise from 1073100 to 18m the level it was at in 2010. Web For pensions the Lifetime Allowance LTA is the overall limit of tax privileged pension funds a member can accrue during their lifetime before a Lifetime Allowance tax. Chancellor scraps lifetime allowance Chancellor Jeremy Hunt has scrapped the lifetime allowance on pension pots Reuters By Amy Austin In a.

Web The lifetime allowance is the amount that someone can save in total for their private pension without incurring a tax charge. The allowance applies to the total of all the. Web The lifetime allowance LTA on tax-free pension savings will rise as well as the 40000 cap on annual pension contributions the Daily Mail reported citing.

You might be able to protect your pension pot from. The AA was set at 215000 when. Web A reduction in the lifetime allowance means that withdrawals of the same monetary value in 2016 and 2022 used a greater percentage of LTA.

Web The lifetime allowance for most people is 1073100 in the tax year 202223 and has been frozen at this level until the 202526 tax year. Web The standard lifetime allowance is 1073100. Mr Hunt will outline his Spring.

Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits. Web The lifetime allowance was 107m with savers incurring tax after that personal pensions pot threshold has been exceeded. Web Jeremy Hunt increases annual pension allowance from 40000 to 60000 Chancellor also abolishes lifetime cap on pensions savings in surprise move By Greg.

The Chancellor is also set to increase the 40000 cap on tax-free. Web Lifetime allowance You usually pay tax if your pension pots are worth more than the lifetime allowance. This is currently 1073100.

Web Currently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m. Web Budget 2023. The chart below shows the history of the lifetime allowances.

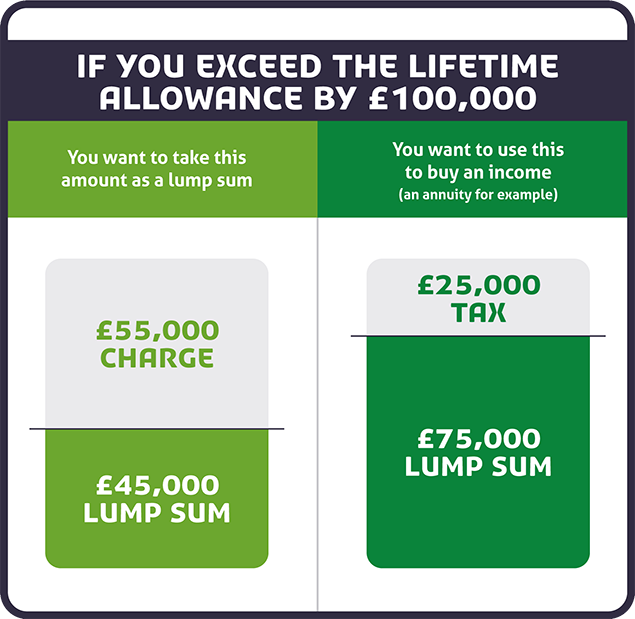

Web The lifetime allowance charge applies to individuals who have benefits in excess of the lifetime allowance when benefits are taken. Tax free cash also known as a pension commencement lump sum PCLS will. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge.

Web Labour has claimed that changing the lifetime allowance would cost the taxpayer 70000 for every person who stays longer in the labour market as a result. Tax relief on any pension benefits taken over this amount is recovered by the application of the lifetime allowance. Web Under section 214 the LTA sets a limit on the total tax-relieved pension saving an individual can have over their lifetime.

Hunt also increased the annual pension. Web The lifetime allowance currently stands at 107million with savers incurring tax after that personal pension pot threshold has been exceeded.

Pension Allowances Part 2 Lifetime Allowance Boosst Financial Insights

Understanding The Impact Of The Lifetime Allowance With Strategies That Could Work For You Netwealth

Pension Lifetime Allowance Explained St James S Place

Ruaz0igmqqkdom

Gssj1uzewwuosm

Z5kw8dvwrqdkm

Lifetime Allowance Charge Royal London For Advisers

Pension Lifetime Allowance What Is It And How It Works

What Is The Pension Lifetime Allowance The Money Movement Ybs

Pension Lifetime Allowance Lta Uk Pension Help

The Pension Lifetime Allowance And Lifetime Allowance Charge Explained Youtube

Xjfvamqpnxrdhm

Impact Of Soaring Inflation On Pensions Lifetime Allowance

The Lifetime Allowance Lgps

How To Cope With The Lifetime Allowance Aj Bell Investcentre

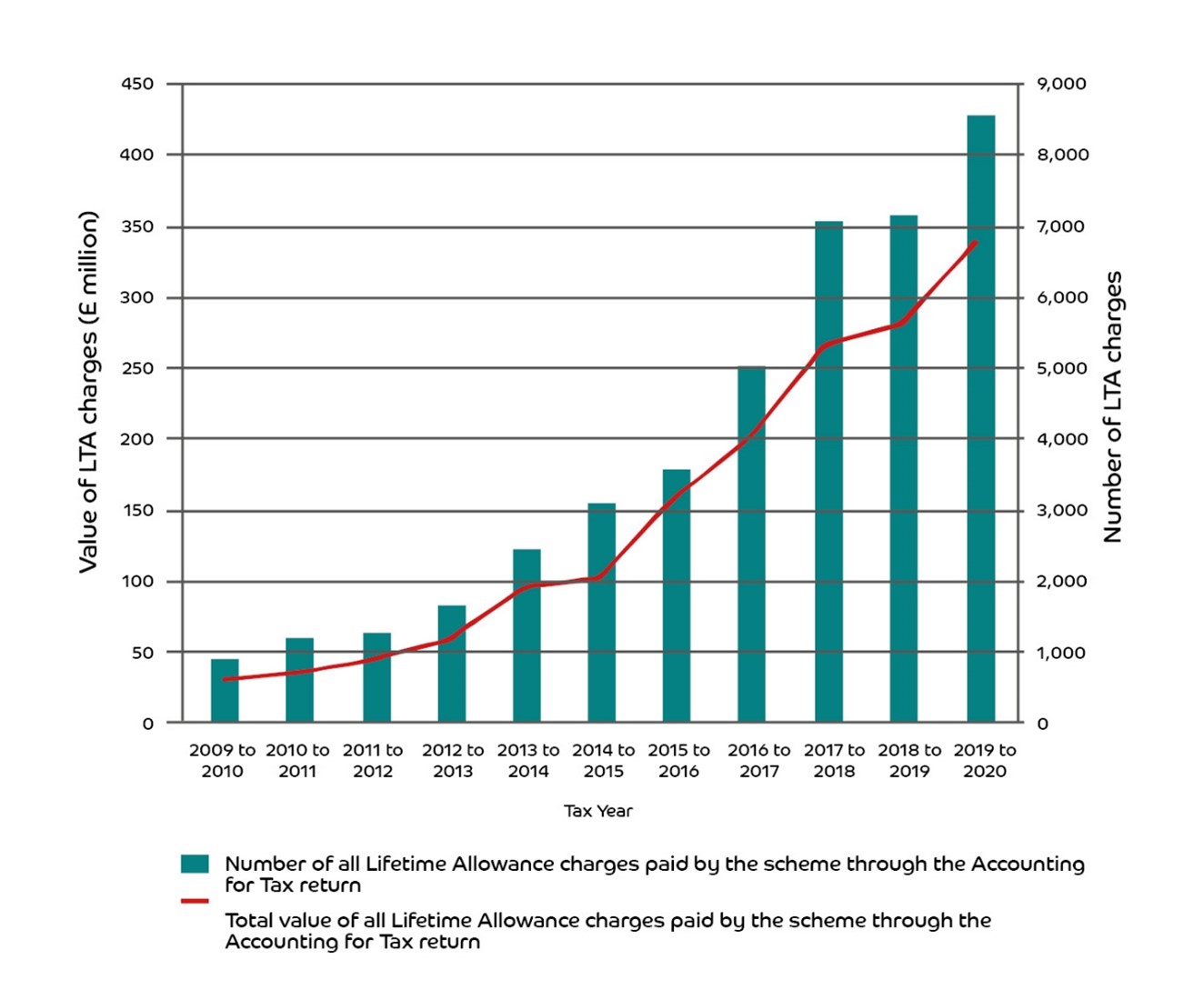

Pension Lifetime Allowance Tax Take Jumps By Over 1 000

1uuqbdv2buutum