Average taxes taken out of paycheck

The average tax wedge in the US. Calculate average monthly.

Here S How Much Money You Take Home From A 75 000 Salary

Learn how to create an employee handbook.

. The Beaver State also has no sales taxes and below-average property taxes. That 250 would be pulled for your insurance payment and youd pay taxes. You should fill out a new form every time you start a new job or make a life change like getting married or adopting a child.

Dive into this 11-chapter article for an in-depth look at how to manage your staff. You can learn more about how the Ohio income tax compares to other states income taxes by visiting our map of income taxes by state. The IRS applies these taxes toward your annual income taxes.

This resource can help you decide what to include. 2020 and either had employees for whom you paid salaries and payroll taxes or paid independent contractors as reported on a Form 1099-MISC. However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed.

Ohio has been systematically lowering personal income tax rates since House Bill 66 was passed in 2005. Instead of no federal taxes taken out of paycheck you may simply find that not enough is being withheld. How do you know that.

Your Form W-4 determines how much your employer withholds. Learn everything you need to know about hiring your first employee. However it may provide even more value spread out throughout the year rather than receiving it all at once.

Also keep in mind that these accounts take pre-tax money. This windfall at tax time can be handy. Someone would have to pay just the right amount of taxes so that they wouldnt owe or get a refund when they file their tax returnin that case the average rate of 346.

State Average Property Tax Rate 0845. The tax wedge isnt necessarily the average percentage taken out of someones paycheck. Write 25 on the line of the W-4 that asks how much of an additional withholding.

Can the average American pay no taxes. Calculated from actual data The second average calculated by multiplying last years average by the annual change in wages For fun the figures below concerning percentages are taken from the data SSA provides but are themselves not averages or medians. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month.

Section 1102 of the Act temporarily adds a new product titled the Paycheck Protection Program to the US. How Much Money Gets Taken Out of Paychecks in Every State. The last scheduled tax reduction was applied for the 2011 tax year and taxes were lowered over 15 since 2004.

Skip to Content Sections Money. State Inheritance and Estate Tax Rate Range. Indeed some taxpayers even those with investment income over 100000 could pay zero tax.

Some of it also goes to FICA taxes which pay for Medicare and Social Security. Smith contributes 2750 per year to her healthcare flexible spending account which is also deducted from her paycheck pre-tax. Since 1986 it has nearly tripled the SP 500 with an average.

So the average of the Top 1 is not 250000 a year its how much you need. State Income Tax Rate Range. And this amount is taken out of her paycheck pre-tax.

Your employer will pay an additional 62 percent Social Security tax on you for a total. In fact youre in the majority. Check out these resources to help you hire the right way the first time.

In addition to federal withholdings though youll also have Social Security taken out at 62 percent. According to the IRS over 247 million tax refunds were issued in fiscal year 2021 and the average refund was 2959. Keep reading to find out all the details about state taxes in Arizona and how they will affect the size of your paycheck.

Was about 346 for a single individual in 2020. Like a 401k or to a medical expense account like a health savings account H SA will also come out of your paycheck.

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Verify Is California The Worst State For Your Paycheck Abc10 Com

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Are Payroll Deductions Article

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Paycheck Taxes Federal State Local Withholding H R Block

Irs New Tax Withholding Tables

Check Your Paycheck News Congressman Daniel Webster

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

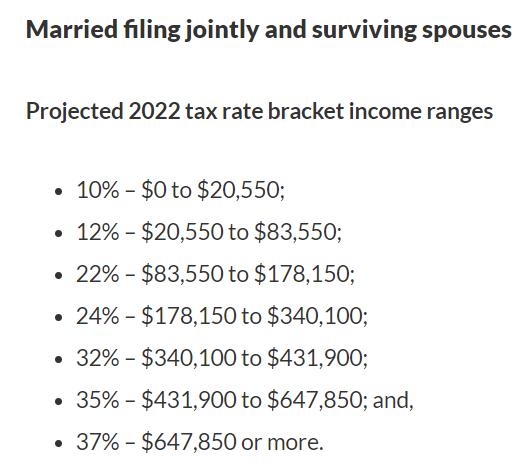

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Understanding Your Paycheck

Here S How Much Money You Take Home From A 75 000 Salary

My First Job Or Part Time Work Department Of Taxation

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com